TCL Makes It Official

TCL will be using ink-jet printing, although details of which process steps will include IJP have yet to be revealed. Ink-jet printing, which is used by Samsung Display to deposit quantum dots on their QD/OLED process, and others for OLED encapsulation, would replace the highly material inefficient vacuum deposition and FMM process used currently. This (FMM) process wastes up to 70% of the OLED material, which winds up coating the interior of the deposition chamber and the mask, and causes downtime in order to remove that material with harsh chemicals. Ink-jet printing has a much higher material utilization rate of 85% to 90% and is therefore expected to be more cost effective and enable TCL to produce IT OLED products at a lower cost.

Of course, all of this is speculation as TCL has only been running a Gen 5.5 pilot ink-jet production line in Wuhan, producing one size displays for the medical industry. Gen 8.6 substrates are over 3 times larger, pushing the limits of ink-jet technology, so we are quite conservative as to when the TCL fab will enter true mass production and what yield might look like. As noted, little is known about TCL’s ink-jet process, but we know with a substrate of this size the mechanics of placing 340 pixels per inch containing three sub-pixels (RGB) each requires considerable engineering expertise. Panasonic (6752.JP) is said to be supplying the ink-jet equipment, but little else is known about TCL’s process and how easily it might scale.

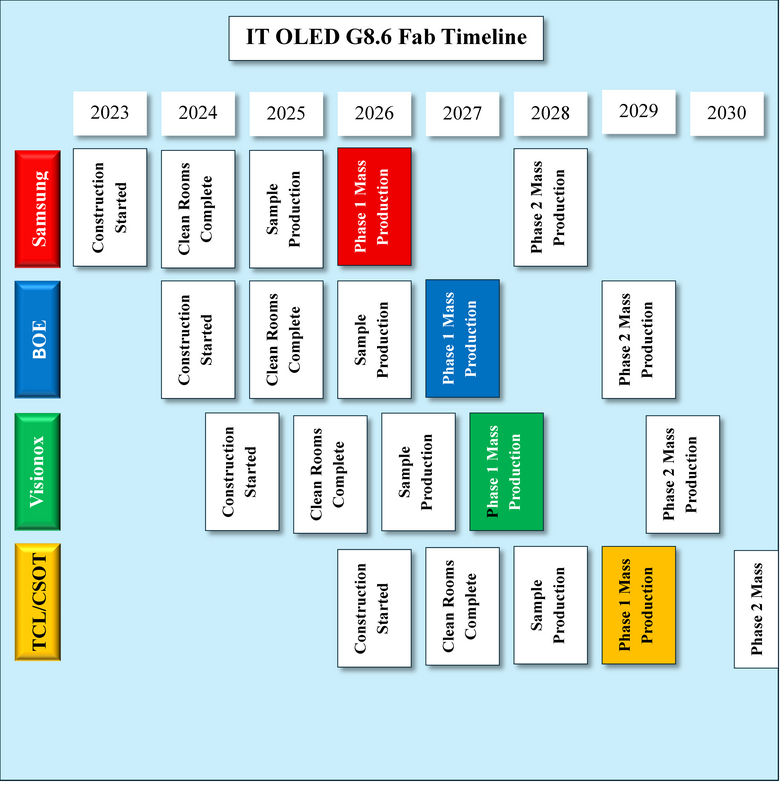

producers who have committed to building such fabs, only two are using the standard vacuum deposition FMM process that has been used for smaller (Gen 6) OLED production. With TCL committed to ink-jet and Visionox committed to a photolithographic deposition process, there will be less commonality across the equipment industry, especially given how little is known about how these new processes will scale. Everybody is watching everybody to see if things are progressing, but we are still at the cusp of mass production for SDC’s phase 1 VD FMM line, and we expect that is the easiest of the three technologies to scale. It will be a while before anyone can claim success.

RSS Feed

RSS Feed